This is a weird post to write. You’re probably already thinking “That title makes absolutely no sense… I’m going to stop reading”… DON’T STOP READING. This post shares some of the most valuable advice we were ever given in regards to our finances. I have always had this crazy idea that investing and “wealth management” was only for the rich. Surely you don’t meet with a financial planner without having any money right? Wrong. My idea of financial planning was so warped.

Michael and I absolutely love what Dave Ramsey teaches about managing your money and staying out of debt. He’s a genius when it comes to financial planning and we’re in love with his new book “The Legacy Journey”. The Legacy Journey is all about managing wealth and using your money to changes lives and leave a legacy! And that’s what Michael and I want one day! However, I have always thought that “wealth” was a term that you use when you’re talking about old people. Old men on golf courses are the ones that have financial planners, right? Again… very wrong. Michael and I are SO thankful that we have some people in our lives that have educated us about what financial planning is really supposed to look like!

My parents have been meeting with Steve Fish and David Arnold for years and told them that we needed to set up a meeting. After a year… yes, you read that right, ONE YEAR of emails back and worth, we actually found a date to meet with them. I didn’t want to meet with them because of a few reasons:

- We didn’t have a lot of money to invest.

- We had no knowledge of what financial planning was supposed to look like.

- We thought we were doing pretty awesome without it!

Well, like most life lessons, we were pleasantly surprised at how WRONG we were. We quickly realized that meeting with a financial planner isn’t something that only the wealthy do, it’s something that EVERYONE should do… no matter what your income is. You don’t need wealth to start planning your financial future… you just need a game plan.

I remember our first conversation with Steve and David. They started with a conversation about our future and what we were envisioning for ourselves financially. After a few meetings, we were AMAZED at how much we had accomplished. We didn’t enter into our financial planning meetings with a lump sum of money to invest, we just entered into it with a lot of questions! This was a game changer for us. We had the chance to sit down and just ask question after question. I had so many questions about disability insurance, SEP Funds, investment options, life insurance, a will….etc. Slowly, little by little, we started to invest and really be intentional about our long term goals!!

I’m passionate about this because I see so many couples AVOID financial planning meetings because they “Aren’t in that place yet”. Well, if you don’t listen to anything else I share today, a least remember this…. You need to start planning for the future now… whether you have money or not!!! You need to think about your will, your goals and what you can realistically start putting into retirement in the future. It NEVER hurts to talk about this! We are SO thankful that we have had those conversations and I HIGHLY recommend that others begin this journey as well!

Remember : WEALTH doesn’t start with MONEY…. it starts with WISDOM.

I hope that this posts serves as a little kick in the butt to all of those that know they NEED to start these discussions! Make it HAPPEN! You’ll sleep better at night knowing that you’re covered and you have a plan!

Disclosure of Material Connection: Some of the links in the post above are “affiliate links.” This means if you click on the link and purchase the item, I will receive an affiliate commission. Regardless, I only recommend products or services I use personally and believe will add value to my readers. I am disclosing this in accordance with the Federal Trade Commission’s 16 CFR, Part 225. “Guides Concerning the Use of Endorsements and Testimonials in Advertising.”

Thanks for reading!

— Katelyn

MORE RECENT POSTS

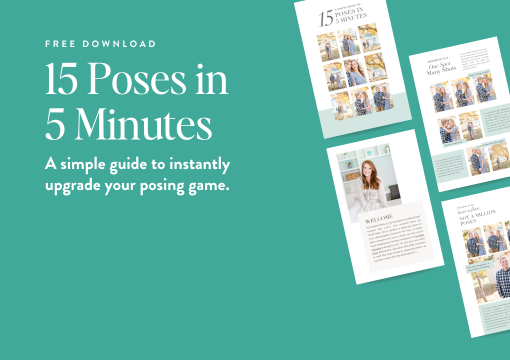

Have you ever started a session, camera in hand, and suddenly felt stuck? Your couple is standing there, looking at you, waiting for direction… and your mind goes blank.

Have you ever tried to sit down with your spouse to talk about dreams, goals, and vision—only for it to turn into frustration or misalignment? If so, you’re not alone. Vision casting in marriage is hard because it brings up deeper fears, beliefs, and unspoken dynamics that many couples don’t even realize are at play.

Success—it’s a word we hear all the time. But what does it really mean? Is it about financial security? Status? Owning a dream home or taking extravagant vacations?

When you think about your business, do you see it as simply a job—or something more?

Today, I’m diving into an experience that was nothing like I anticipated: my digital detox in December. If you’ve ever considered taking a break from the noise of the online world, you might relate to my journey—the good, the surprising, and the, well, completely unplanned.

The wedding industry has faced unique challenges recently, with inflation affecting budgets and couples cutting costs. If you’re a wedding photographer feeling the pinch, don’t worry—2025 doesn’t have to be a slow year.