anyone ready for tax season to be OVER?! This girl is!!! Whew. Everyone dreads this time of the year and all of the small business owners are PRAYING that their estimated taxes and write-off’s will be enough to cover their return. Well, while I can’t promise to save you a TON of money on your taxes, I CAN share with you how we have saved ourselves some tax-prep time by making simple changes in our business. Taxes don’t have to be so scary and overwhelming! For years I just barely understood what the tax process was even though I’m DEFINITELY not a pro now,

I have a MUCH better understanding of what all goes into the tax process. Don’t be afraid to ask a ton of questions with you CPA…. that’s the only way we learn! So here we go!:

1. CREATE A SYSTEM FOR RECORDING AND ORGANIZING THE FOLLOWING:

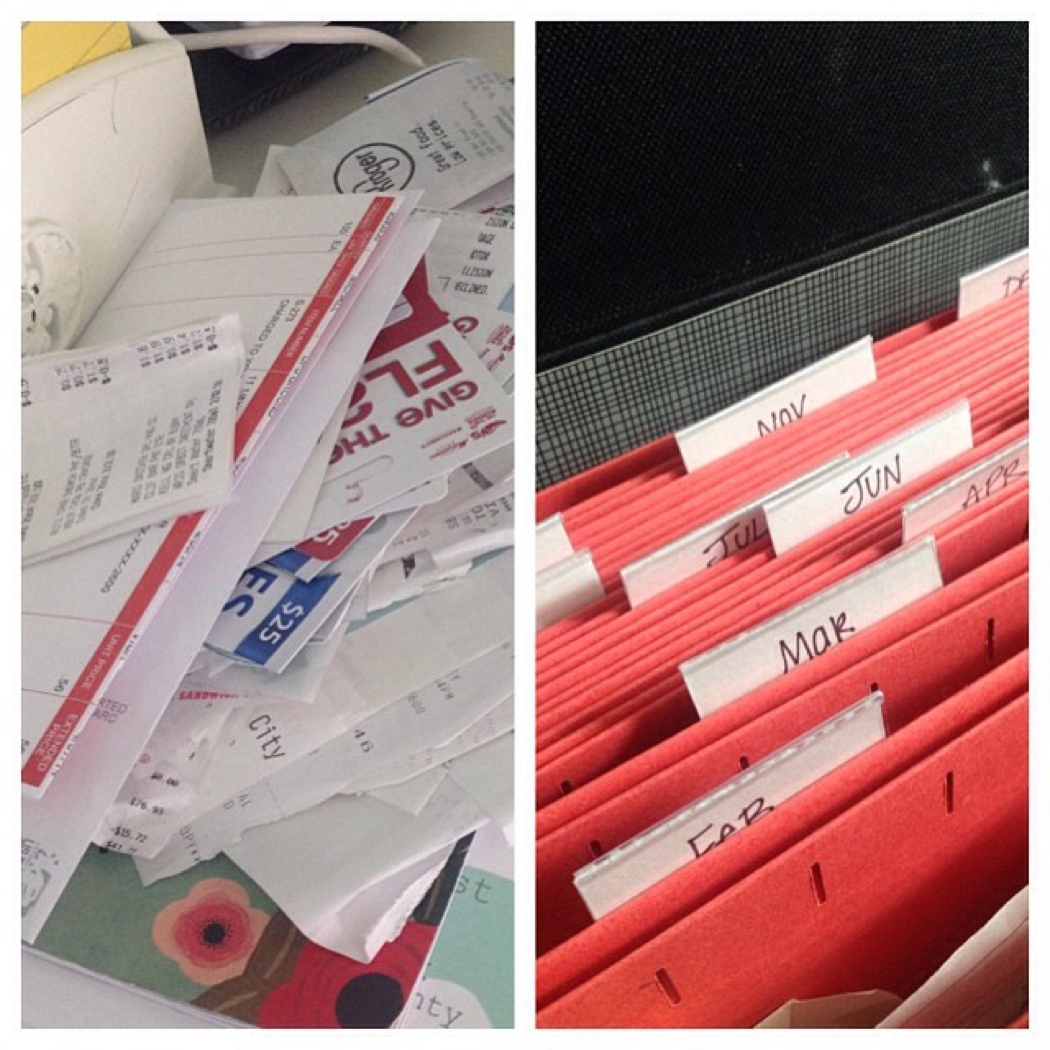

- EXPENSES & RECEIPTS : We use Mint.com to track our expenses and categorize them automatically. At the end of the year, we export our expenses from Mint into categories that our CPA requests. It’s free and fast! We only keep receipts for audit purposes. They just need to be categorized by MONTH. So I have 12 file folders in my desk labeled for every month. I throw business receipts on my desk and at the end of the month I toss the pile into the current month’s folder. At the end of the year, we paperclip the receipts by month and store them. For electronic receipts, we save them in Email folders!

- MILEAGE (Or ALL auto receipts if you have a business car): I recommend doing this once a month! Add it to your monthly list of “to-do’s” for the business! We add it to our Monthly Duty Day! By all means, don’t wait until the end of the year!!! Ah! Talk about overwhelming!! There are programs and apps that will do this for you as well!

- INCOME OF ALL KINDS: We receive income from a few sources and so we can’t just take our credit card processing statement to our CPA at the end of the year, we have to record everything that comes in. We do this in a basic spreadsheet! We make sure we categorize income so that we can see how much we’re bringing in from Education, Deposits, Final Payments and Album Sales.

- CHARITABLE GIVING: I recommend printing and filing any records of charitable giving each year. Try not to make a donation from the business in CASH! That’s very hard to record and remember!

- HOUSEHOLD UTILITY RECORDS (If you have a home office): If you have a home office, a certain percentage of almost ALL of your utilities can be written off as a business expense! I recommend creating a list of all of your home expenses so that it’s easy to gather these records at tax time! Just finding a few extra bills saved us $1300 this year!

- SMALL EVERYDAY EXPENSES : If you buy tissues for your desk and diet cokes for the mini fridge in your office… those are write offs. Anything that you buy specifically FOR the business/office needs to be purchased with your business debit or credit and recorded into your annual expenses. It’s easy to over look these things. If you go to Target and buy post-it’s, staples, computer paper and mascara… I know it’s a pain but that mascara needs to be on a separate transaction. Pay for the office items on your business card. If you spend $20/month keeping the office stocked, that’s $240 a year that you shouldn’t be paying in income tax.

2. HIRE A CPA THAT YOU CAN MEET WITH AND WHO SPECIALIZES IN SMALL BUSINESSES:

If you aren’t doing a great job with your bookkeeping, I would highly recommend investing in having your CPA do your monthly bookkeeping. It will save stress and you’ll LOVE tax time at the end of the year because everything will be recorded and ready to be filed! Well, you won’t LOVE it… but it won’t be painful!

3. COMMIT TO SAVE 1/4 OF ALL OF YOUR INCOME FOR YOUR ESTIMATED TAXES AND END OF THE YEAR RETURN:

If you taxes don’t exceed 1/4 of your income, you haven’t lost anything…. you just have a great savings account for your business!! This is REALLY important if you are having a GREAT year financially because your estimated taxes are not going to cover your return amount.

4. SUBMIT YOUR TAX INFORMATION EARLY:

If you send your tax information in early, you can be prepare for the damage while there is still time to make a large business expense. (We should have done this in 2013!!!). If you wait until the new year to find out where you stand with your taxes, the ONLY way to reduce what you owe is to put income into a SEP fund before April 15th… and you can’t touch that until retirement. Which leads me to my final point:

5. KNOW YOUR OPTIONS:

Talk to your financial advisor or CPA about your investment options. Every self employed individual can “put away” a certain percentage of their income every year into a SEP fund. There are other options as well. So for example, if you saved 1/4th of your income for your taxes but only used a portion of that money, you could place the remaining balance in a SEP account and reduce what you owe significantly.

Thanks for reading!

— Katelyn

MORE RECENT POSTS

Kelly is an incredible wedding photographer who has been shooting 90 weddings a year. I know, it sounds unbelievable, but it’s true! Kelly’s success and the volume of work she handles is truly impressive.

Your sessions should be working FOR you not against you!

Shooting in manual mode might seem complex and overwhelming at first but there is an easier way!

Welcome to your Lightroom Classic Starter Guide video!

I’m breaking down the MUST-HAVE ITEMS that every photographer needs to be successful at the start of their career!

Oh where do I begin? This wasn’t just another wedding for me. This was a legacy KJ Wedding and I have been looking forward to it ever since my first email from Danny and Megan!